It has almost been a year since my last budgeting post. With no new additions (i.e., truck or baby-on-the-way news), this year’s budgeting goals are only slightly different than last year’s (which you can read about here).

You guessed it. We are still fervently paying on my student loan and Myrtle, our truck loan. To get us out of the red, we are also still utilizing the Debt Snowball Method, introduced to us by Dave Ramsey, a few years ago. Our progress is slow, seemingly slower than years past. Regardless, we are still motivated; diligently working, monitoring our budget and balances owed, weekly, to get out of debt.

As mentioned in previous posts, we are paying more than the minimum payment on both my loan and our truck loan, which keeps us on the fast track in paying each off. For the past several months; however, we’ve been tucking all discretionary income into a savings account with the goal of installing a new roof on our home come August. Our goal is to save enough money for this project that we won’t need to borrow more money from the bank, open a line of credit or ask family for a huge financial favor.

Surprisingly, we are approximately $1,000 shy of our goal. Due to some unexpected obligations – taxes, new summer tires and some car maintenance – we had to borrow money from this savings account. With said obligations fulfilled and payday just around the corner, we should be back on-track to meet our re-roof goal and, sooner than expected.

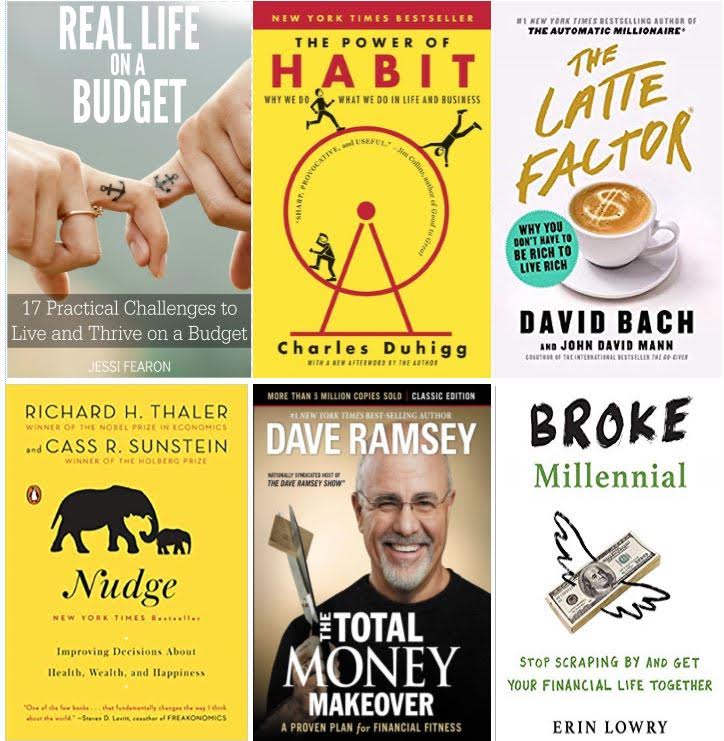

Once we meet this goal, the plan is to simultaneously rebuild our savings and continue to hammer away at our debts. For now, our debt-free journey is cyclical and will remain that way until our debts are paid in full, which could be a few years from now. To keep our momentum and not get discouraged, I’ve got a list of books I’d like to read or listen to this summer. Any other suggestions? A personal favorite from this list?

Love it!

We have had some luck in the last couple years after reading this book. Kinda old, but the concepts are timelessly awesome. Including some really great information on Retirement account action.

Good to hear from you and hope all is well.

Cheers,

p.

https://www.amazon.com/Smart-Couples-Finish-Rich-Creating/dp/0767904842