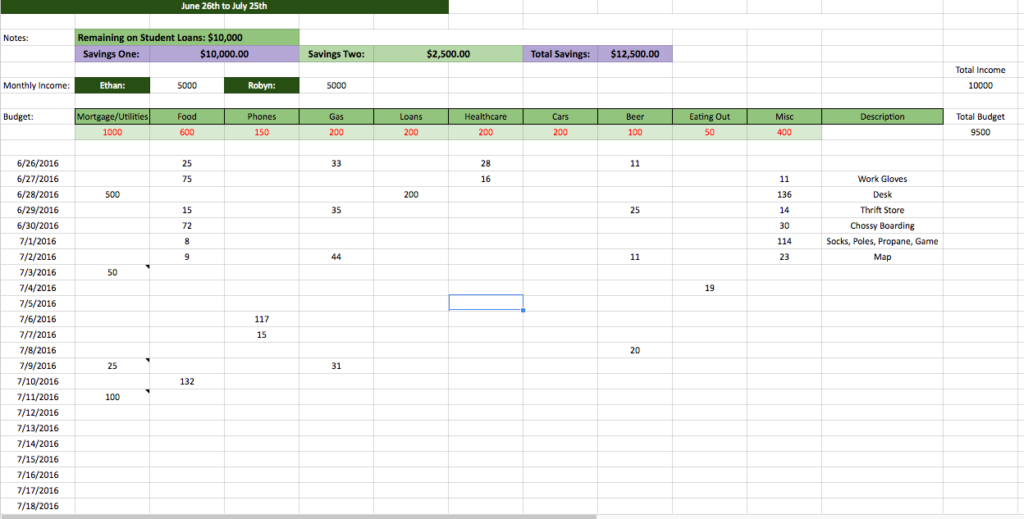

As promised from my previous post, I’ve crafted a Sample Budgeting Spreadsheet; one that we strictly adhere to each month (I’ve deleted our own numbers and notes, and have added in some random amounts. Even though I am open and comfortable talking about finances, I apparently draw the line somewhere).

For your use or reference, I’ve included the link to the Budgeting Spreadsheet, with the option to download. Once downloaded, you should be able to edit and add your own numbers to the spreadsheet.

Disclaimer:

This plan has worked really well for us. We’ve been using it for six years or so and are happy with the outcome. That said, money is individual. What works for one person or family may not work well for another. Don’t get discouraged. Continue to augment the plan until you find something that works well for you. Then, stick with it.

Filling in the spreadsheet:

Whenever we purchase an item, whether it be a cup of coffee or a pair of shoes, we keep the receipt and log the total amount paid on our spreadsheet (we round up to make our calculations a bit easier). Once the receipts have been logged, we dispose of them. We log other items, too, like the total amount in our savings, as well as the remaining balance owed on our student loans. These numbers get updated at the end of each month to more accurately reflect what we have, in savings and in debt. Items that are consistent or fixed, like our home mortgage, internet and phone bill, and student loan payments are all added in without a receipt. I do this at the beginning of each month so we don’t accidentally spend more than what we really have.

Categories:

We like to categorize our spending. Our categories were determined based on where we put most of our money. Additional expenses or items purchased less frequently are lumped together under Miscellaneous. Any item that falls under Miscellaneous is accompanied by a Description. This allows us to know exactly what was purchased and for how much. Categories are personal. Feel free to re-categorize as you need. The purpose of this spreadsheet is to be a helpful tool. If it’s not easy, continue to adjust until it becomes habitual, maybe even fun.

Calculations:

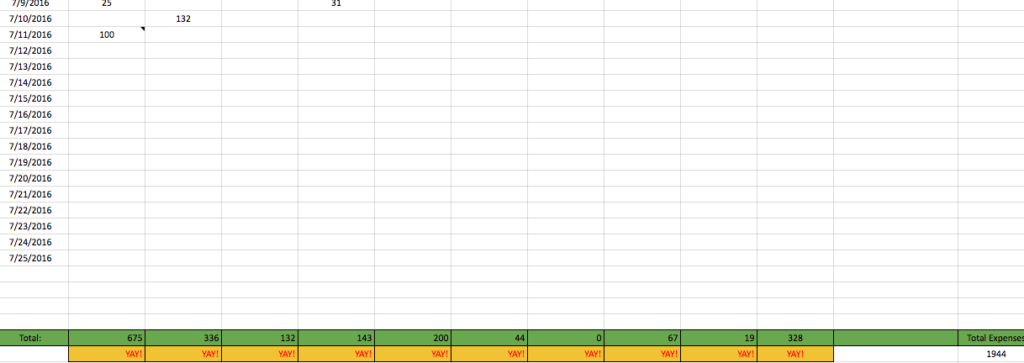

We’ve set spending limits on each category and are deliberate about adhering to our allotted amounts. For every entry we make, the total (at the bottom of the spreadsheet) updates accordingly. Then, the sum of each category total is displayed at the bottom, right-hand corner of the spreadsheet, under Total Expenses. We frequently compare this total to our Total Budget (top, right-hand corner of the spreadsheet). If we are under our Total Budget, YAY! If not, we carry the amount we are over to the following month’s budget to account for our overspending. Simple as that.

Here’s a snapshot of the calculations. You can see the entire spreadsheet by clicking on the link above.

Again, there are several great budgeting tools out there. I am certainly no expert, I am just fascinated by this stuff.

You two are freakin awesome. In a world where people dont care if they are deadbeats it’s really refreshing to have you guys doing so well with your finances and being so responsible. You are the kind of people that give all of us hope for the future and I am so incredibly proud of you. Keep up the good work! love you, pops.

Ditto what the old man said 🙂 You are rockin it.

Haha I love that you guys have a category dedicated to beer. Nice touch. We do something very similar, and track all of our expenses through a spreadhseet that we share through Google Docs. That way we always have it with us and either of us can update it at any time. Ours has a primary summary spreadsheet, and then 2 sheets that go with it per month separated out into finer categories. Everything is linked and will show us carry over. or debts from the previous month. It’s worked great for us for almost 4 years now, and keeps us honest and makes it easy to track trends.

The one thing that I haven’t integrated into ours is what debt (like auto loans) we have remaining and tracking against that. Mainly because of the interest calculations in there. I wish I could attach photos to the reply to show you a bit of what ours looks like.